Working while in college might hurt students more than it helps

Anthony P. Carnevale, Georgetown University Center on Education and the Workforce

Source: CNBC

Back-to-school season is in full swing for students throughout the educational pipeline. On college campuses, many students are starting their journey from youth dependence to adult independence—and making their first and probably one of the largest investments of their lives. For most, that means taking out college loans, assuming student debt, and finding a job to help stay afloat.

It didn’t always use to be this way. Since 1980, tuition and fees at four-year public colleges and universities have risen 19 times faster than average family incomes. Given the costs of college, working while enrolled is the new normal for today’s students; eight out of 10 students work while in college. But the reality is that working while in school doesn’t leave enough to cover living and tuition costs. You just can’t work your way through college anymore.

(more…)Americans Now Need at Least $500,000 a Year to Enter Top 1%

One definition of rich is getting into the top 1%. If that’s your goal, it’s becoming harder to reach.

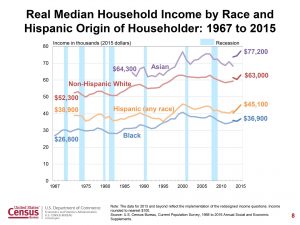

The income needed to exit the bottom 99% of U.S. taxpayers hit $515,371 in 2017, according to Internal Revenue Service data released this week. That’s up 7.2% from a year earlier, even after adjusting for inflation.

Since 2011, when Occupy Wall Street protesters rallied under the slogan “We are the 99%,” the income threshold for the top 1% is up an inflation-adjusted 33%. That outpaces all other groups except for those that are even wealthier.

To join the top 0.1%, you would have needed to earn $2.4 million in 2017, an increase of 38% since 2011. The top 0.01% threshold has jumped 46%.

Meanwhile, the top 0.001% — an elite group of 1,433 taxpayers — earned at least $63.4 million each in 2017, up 51% since the Occupy protests.

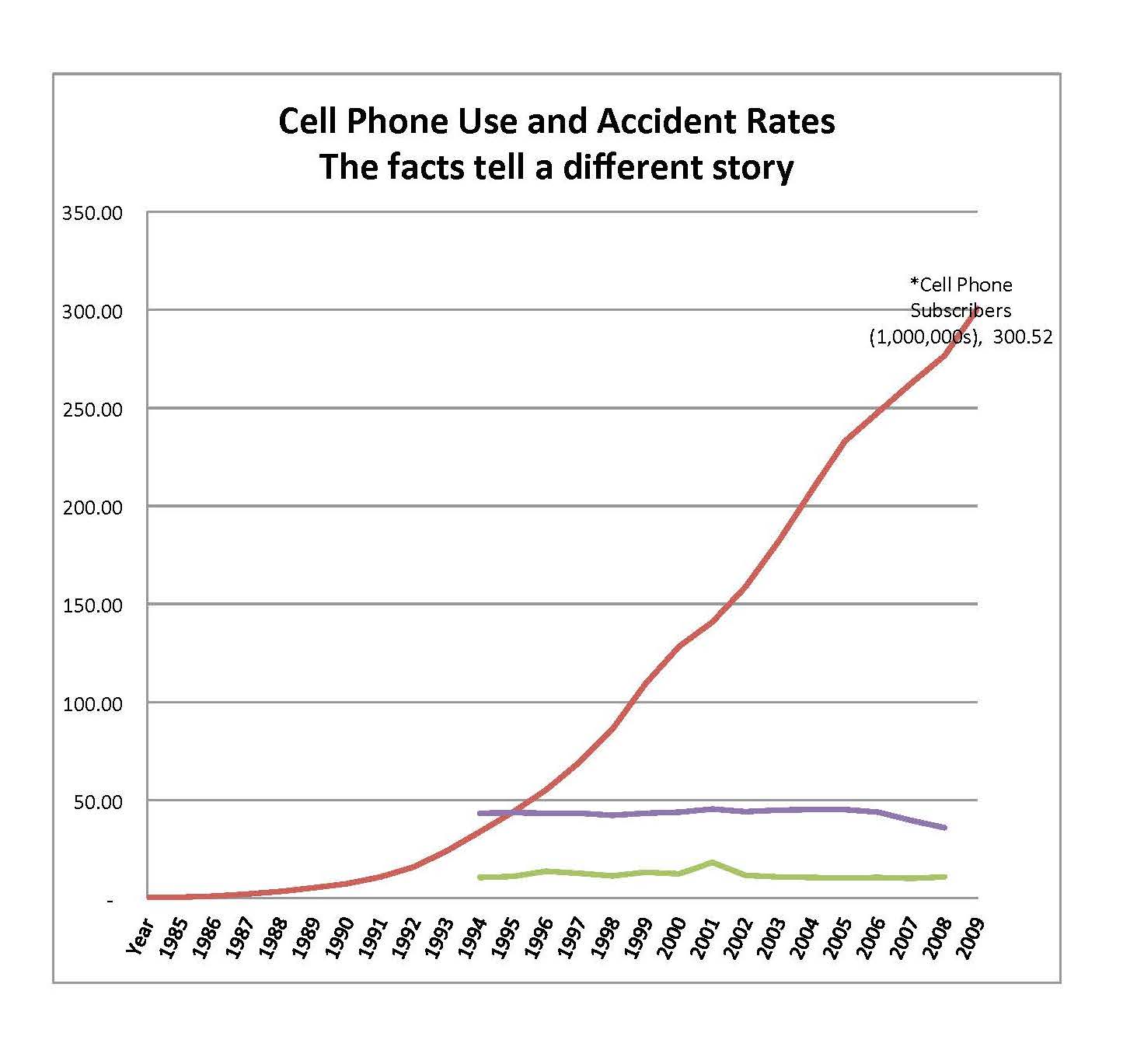

(more…)Cell phone versus accident statistics

By Swint Friday

FINA.3351 Course Materials

PowerPoints

Review Questions

Principles of Insurance FINA.3351

Course Materials

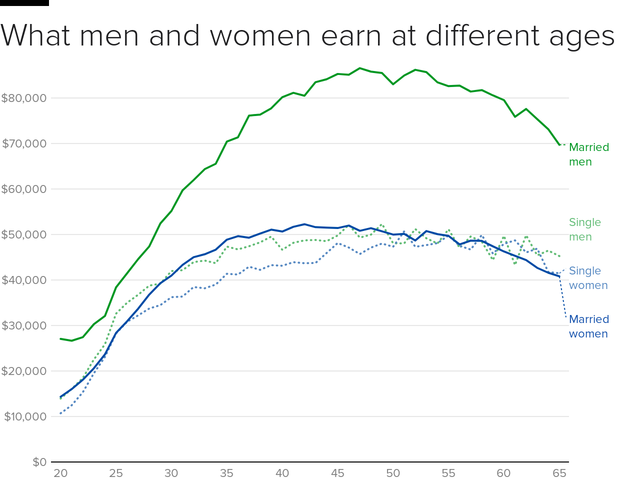

Married Men Are Earning Much More Than Others in America

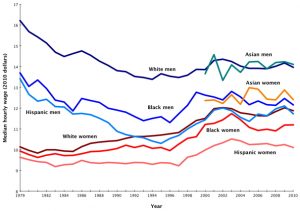

For men, the message is simple. If you want to get paid, get married. For women, unfortunately, working life still presents an seemingly inevitable loss of parity — at least according to new data from the St. Louis Fed.

Married men far outpaced single men and single and married women in their wages and salary through their careers, according to the report. Unmarried men and women have very little difference in income, according to the analysis of all people employed in 2016 with at least a high school diploma. But for women, getting married does little to improve wages, the St. Louis Fed study found.

Married Men Sit Atop Earnings Ladder

Source: Guillaume Vandenbroucke, St. Louis Federal Reserve

Note: Wage and salary income of workers with at least a high school diploma by age, gender, and marital status

The data doesn’t necessarily mean that being married increases a man’s wages, according to the analysis by Guillaume Vandenbroucke, a research officer at the Fed. It may mean men earning higher wages are more likely to marry and lower-income men remain single, the Fed found. Also, married and single women make similar wages, which is “not consistent with the view that the gender wage gap results from women having children earlier in life and losing ground in human capital accumulation relative to men.”

“The gender wage gap remains a complicated topic,” Vandenbroucke wrote in the summary. “But progress may come from asking different questions: not just why women earn less than men (although not compared with single men), but also why married men earn so much more than everyone else.”

By Jeff GreenJust 21 years old, he’s already saved over $100,000

As soon as Nihar Suthar got his first job, as a tutor for his college’s athletics department, he started saving.

“I have been investing since last year, but have been saving money from the time I started college in 2012,” says Suthar, who is now a consultant at the firm Roland Berger in Boston, helping clients figure out ways to cut costs or increase revenue.

To date, his savings, which he keeps in a brokerage account, have grown to $109,000, thanks to money he earned doing odd jobs at school, stockpiling cash from internships and banking a $15,000 gift from his dad for graduating early from Cornell University.

On the side, he writes inspirational books, netting him extra funds from royalty checks.

Nearly half of current jobs could be automated by 2055, according to a new report

This article is published in collaboration with Futurism.

Automation invasion

According to a new report from the McKinsey Global Institute, nearly half of all the work we do will be able to be automated by the year 2055. However, a variety of factors, including politics and public sentiment toward the technology, could push that back by as many as 20 years. An author of the report, Michael Chui, stressed that this doesn’t mean we will be inundated with mass unemployment over the next decades. “What we ought to be doing is trying to solve the problem of ‘mass redeployment,’” Chui tells Public Radio International (PRI). “How can we continue to have people working alongside the machines as we go forward?”

The report suggests that the move toward automation will also bring with it a global boost in productivity: “Based on our scenario modeling, we estimate automation could raise productivity growth globally by 0.8 to 1.4 percent annually.” Removing the capacity for human error and dips in speed due to illness, fatigue, or general malaise can help boost productivity in any task capable of being automated.

Many of the discussions on automation surround how it will impact manual labor. However, while it’s easy to see how robotics can take over precise and repetitive manufacturing tasks, the rise of artificial intelligence (AI) is allowing for more cognition-based tasks to be taken over by computers as well. Chui stated, “In about 60 percent of occupations, over 30 percent of the things that people do could be automated — either using robots or artificial intelligence, machine learning, deep learning, all of these technologies that we’re hearing more and more about.”

What about workers?

Chui believes that mass redeployment is how the workforce will endure the job loss. The report cites the shift from agriculture to industry as another point in history during which mass redeployment occurred. For example, over the course of the 20th century and into today, the United States has moved from having 40 percent of the workforce in agriculture to only less than two percent. “We don’t have 30 percent unemployment because, in fact, we found new things for people to do in the economy,” Chui says. “So we have … historically been able to do that.”

However, the switch from automation isn’t as clear-cut as one from agriculture to industry. The industrial revolution created new roles for masses of people along with machines having a bigger part to play in farming. Automation may create some new roles for some highly skilled workers, but others, especially low-skill workers, will be left without any inherent positions. This is why some experts are heralding universal basic income (UBI) as the only way to ensure the livelihoods of displaced workers.

During his administration, President Obama saw that automation and UBI would begin to enter into our political debates. We are in the infancy of these ideas, but serious conversations need to start if we want to be ready to preemptively tackle these issues before we’re forced to by circumstance.

Written by

Patrick Caughill, Associate Editor, Futurism

This article is published in collaboration with Futurism.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Watch U.S. Oil Drilling Collapse—and Rise Again

By Tom Randall and Blacki Migliozzi

While two dozen nations are coordinating to cut oil production and rein in the global supply glut, U.S. producers are moving in the opposite direction. Over the last four months, output increased by half a million barrels a day. If that rate of expansion continues, the shale boom will break new production records by summer.

https://www.bloomberg.com/graphics/2017-oil-rigs/

After the global plunge in oil prices began in late 2014, producers began shutting drilling operations at an unprecedented rate. The number of active oil and gas rigs plummeted 80 percent to the fewest since Baker Hughes started tracking them in 1940.

The industry that’s returned has been transformed. It employs fewer workers per rig and is even more tightly focused on the rich shale formations that drove America’s oil and gas boom before the crash. Almost 90 percent of the rigs added during the rebound have been of the horizontal variety.

BEER RUN! Self-Driving Truck Goes 120-Plus Miles On Delivery

Oct. 25, 2016 8:26 AM ET

DENVER (AP) — Anheuser-Busch says it has completed the world’s first commercial shipment by self-driving truck, sending a beer-filled tractor-trailer on a journey of more than 120 miles through Colorado.

The company says it teamed with self-driving truck maker, Otto, and the state of Colorado for the feat. The trailer, loaded with Budweiser beer, began the self-driving trip at a weigh station in Fort Collins, Colorado, and ran along Interstate 25 through Denver before wrapping up in Colorado Springs. (more…)