FINA.3351 Course Materials

PowerPoints

Review Questions

Principles of Insurance FINA.3351

Course Materials

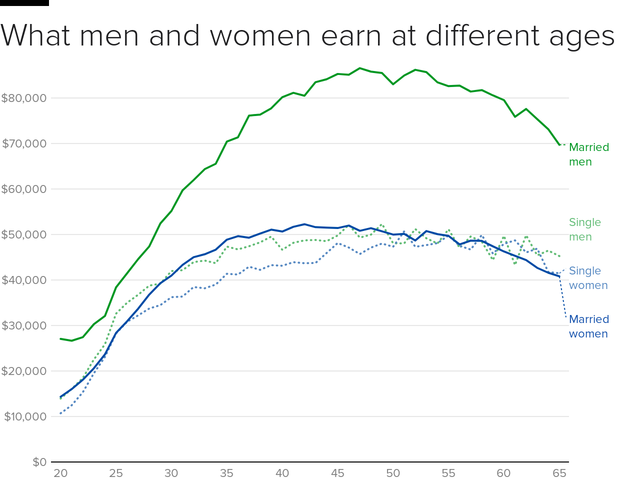

Married Men Are Earning Much More Than Others in America

For men, the message is simple. If you want to get paid, get married. For women, unfortunately, working life still presents an seemingly inevitable loss of parity — at least according to new data from the St. Louis Fed.

Married men far outpaced single men and single and married women in their wages and salary through their careers, according to the report. Unmarried men and women have very little difference in income, according to the analysis of all people employed in 2016 with at least a high school diploma. But for women, getting married does little to improve wages, the St. Louis Fed study found.

Married Men Sit Atop Earnings Ladder

Source: Guillaume Vandenbroucke, St. Louis Federal Reserve

Note: Wage and salary income of workers with at least a high school diploma by age, gender, and marital status

The data doesn’t necessarily mean that being married increases a man’s wages, according to the analysis by Guillaume Vandenbroucke, a research officer at the Fed. It may mean men earning higher wages are more likely to marry and lower-income men remain single, the Fed found. Also, married and single women make similar wages, which is “not consistent with the view that the gender wage gap results from women having children earlier in life and losing ground in human capital accumulation relative to men.”

“The gender wage gap remains a complicated topic,” Vandenbroucke wrote in the summary. “But progress may come from asking different questions: not just why women earn less than men (although not compared with single men), but also why married men earn so much more than everyone else.”

By Jeff GreenJust 21 years old, he’s already saved over $100,000

As soon as Nihar Suthar got his first job, as a tutor for his college’s athletics department, he started saving.

“I have been investing since last year, but have been saving money from the time I started college in 2012,” says Suthar, who is now a consultant at the firm Roland Berger in Boston, helping clients figure out ways to cut costs or increase revenue.

To date, his savings, which he keeps in a brokerage account, have grown to $109,000, thanks to money he earned doing odd jobs at school, stockpiling cash from internships and banking a $15,000 gift from his dad for graduating early from Cornell University.

On the side, he writes inspirational books, netting him extra funds from royalty checks.

Wall Street’s Trick or Treat

Wall Street wants you back!

If you were one of those investors who this past spring “sold in May and went away,” you should know that the seasonal winds will soon shift and begin blowing in a bullish direction.

I’m referring, of course, to the well-known six-month-on, six-month-off seasonal pattern that goes by the name of the “Halloween Indicator.” Followers also refer to it as “Sell in May and Go Away.” In contrast to most of the alleged patterns that Wall Street claims to have discovered, this one turns out to be based on solid statistics. The stock market historically has produced the bulk of its gains in the “winter” months between Halloween and May Day.

STORY FROM HYATT

When his football career ended, he became an Opera sensation

Since the Dow Jones industrial average was created in 1896, for example, it has produced an average winter gain of 5.2%, versus just 1.7% during the summer. Not only is this difference significant at the 95% confidence level that statisticians often use to determine if a pattern is more than just a random fluke, it is not unique just to the U.S. Ben Jacobsen, a finance professor at the TIAS Business School in the Netherlands, has detected the Halloween Indicator in almost all foreign countries’ stock markets as well, and as far back as 1694 in the United Kingdom’s market.

(more…)

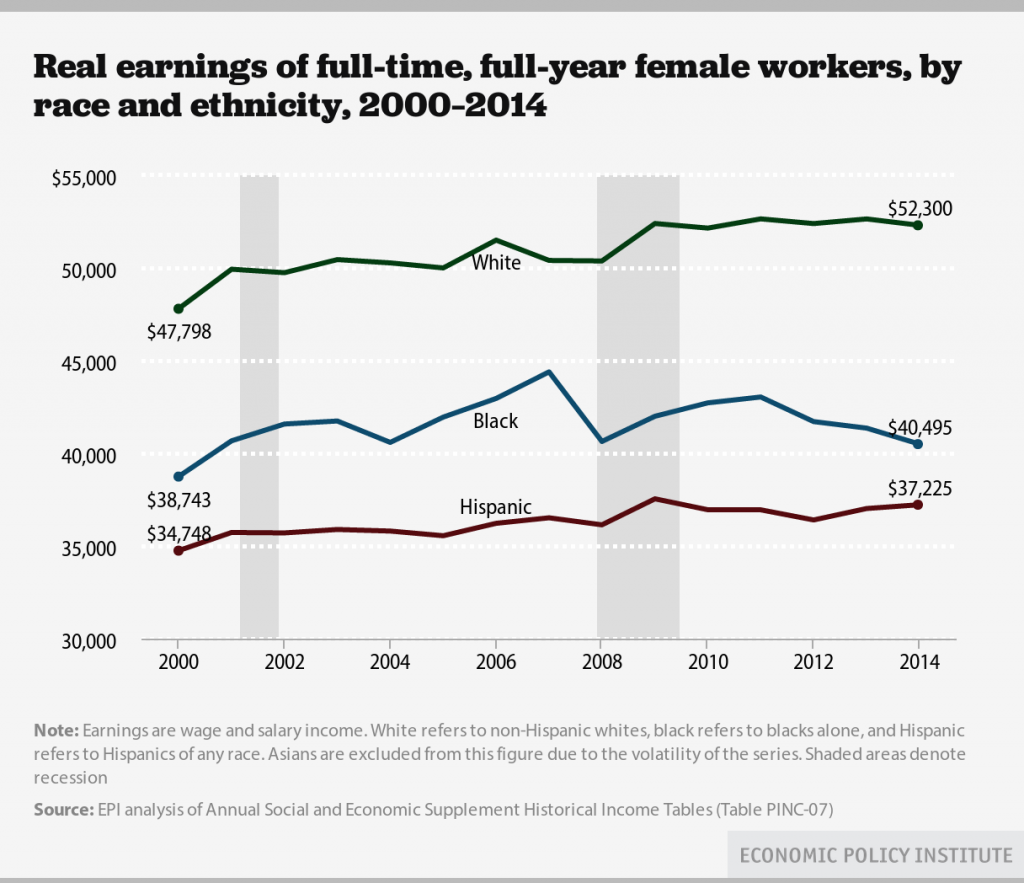

Black families the biggest losers under Carter and Obama Presidencies. Did best under Reagan and Clinton Presidencies.

African American Income

Black Median Household income: $33,460

(all races $50,502)

All Black Workers 2012 weekly earnings:$606

(all races $765)

Black Men weekly earnings: $633

(White men $854)

Black Women weekly earnings: $590

(White women $712)

SOURCE: 2012 3rd Quarter: Bureau of Labor Statistics – 16 Years or Older & 2011 Census Bureau American Community Survey

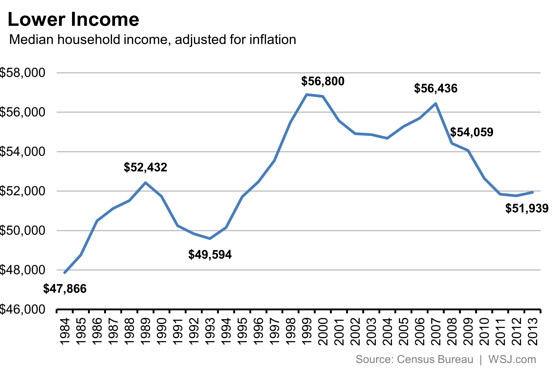

During the 1990s African American income grew tremendously. By 2000, 57.9% of African American households had an annual income of $35K or more compared to just 38.2% in 1970. However due to the recession that number dropped to just 46% by 2011 reversing much of these gains. The most dramatic change during this same period is the percentage of Black households making under $15K (from 14.5% in 2000 to 25.4% in 2011) which is well below the poverty line.

During the 1990s African American income grew tremendously. By 2000, 57.9% of African American households had an annual income of $35K or more compared to just 38.2% in 1970. However due to the recession that number dropped to just 46% by 2011 reversing much of these gains. The most dramatic change during this same period is the percentage of Black households making under $15K (from 14.5% in 2000 to 25.4% in 2011) which is well below the poverty line.

Although incomes for African Americans have improved significantly since the Civil Rights era, they are still lower then the average Americans. For example the median income for Black families is $20 thousand a year less than the American median income. As you can see from the chart labeled Family Income 2010 that Black married-couple families make more than twice that of Female householder families. This charts also proves that there is a substantial benefit for those in a married-couple family regardless of race or ethnicity.

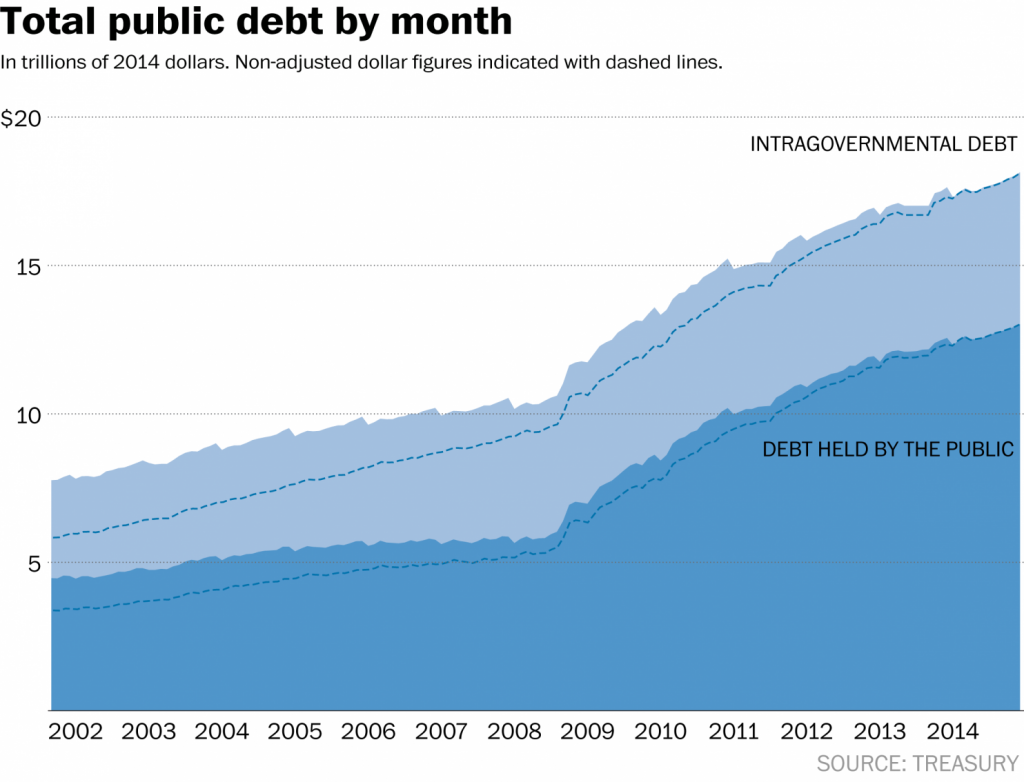

Since 2008, our national debt and deficit has ballooned jeopardizing our future.

The story behind Obama and the national debt, in 7 charts

Since President Obama took office, the national debt has increased by $7.4 trillion. On January 20, 2009, it stood at $10.6 trillion; on Monday, it was at $18 trillion. That bit of data leapt to the front page of The Drudge Report on Tuesday, linking to an assessment from CNS News.com. The increase, the site’s Terence Jeffrey writes, “is $65,443 per household, $70,985 per full-time worker and $84,266 per full-time private-sector worker.” Grim.

We thought those figures deserved some context.

These are the data on which the argument hinges. The Department of the Treasury releases daily updates on the amount of debt held by the government. There are two categories: debt held by the public, which is the sort of debt you think of when you think of government debt — Treasury bills and bonds and notes and so on — and “intragovernmental holdings,” which are securities held by other government accounts. The CNS News article didn’t adjust for 2014 dollars, which we’ve done below.

Before 2009, it was relatively flat. Then, it exploded — almost entirely in the “held by public” part of the debt.

But if you zoom in a little closer, say, from January 2008 to January 2010, you see something interesting: the fuse was lit before Obama took office. (Note that this graph is only the “held by the public” part of the debt.)

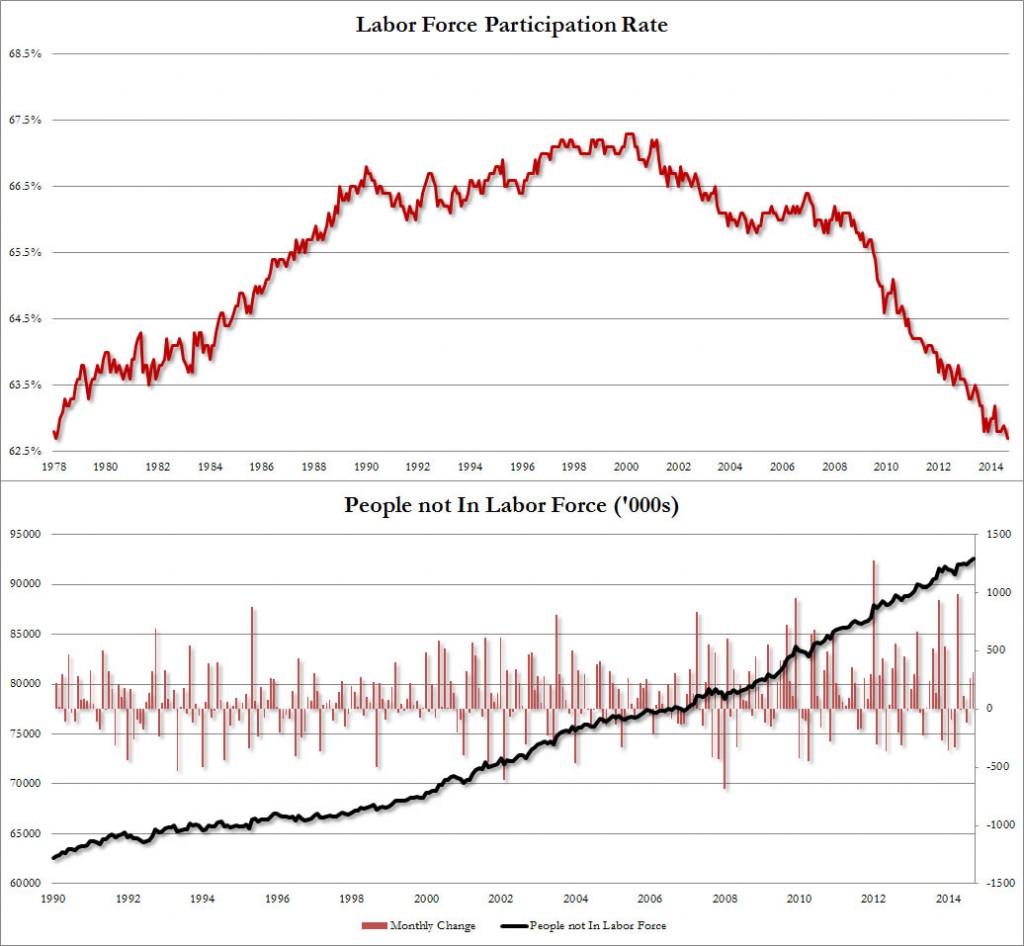

We have the worst workforce participation since Carter.

Labor Participation Rate Drops To 36 Year Low; Record 92.6 Million Americans Not In Labor Force

While by now everyone should know the answer, for those curious why the US unemployment rate just slid once more to a meager 5.9%, the lowest print since the summer of 2008, the answer is the same one we have shown every month since 2010: the collapse in the labor force participation rate, which in September slid from an already three decade low 62.8% to 62.7% – the lowest in over 36 years, matching the February 1978 lows. And while according to the Household Survey, 232,000 people found jobs, what is more disturbing is that the people not in the labor force, rose to a new record high, increasing by 315,000 to 92.6 million!

And that’s how you get a fresh cycle low in the unemployment rate.

So the next time Obama asks you if you are “better off now than 6 years ago” show him this chart of employment to the overall population: it speaks louder than the president ever could.

Heightism not Sexism explains wage disparity.

Australian Economist find that height is as or more dominant than sex in wage disparity. Very simply, the taller a PERSON is the greater their pay. Men on average are 8.5% taller than women explains virtually all of the wage gap.

Read more…

$1,000 pair of Lou Boutins worth their height in inches!

Tall women’s salaries leave short girls in the shade

It may be a tall order for some women to accept.

But shorter females earn less than their loftier colleagues, a study claims

Those who stand at 5ft8in and above are twice as likely to earn more than £30,000 a year – or up to £5,000 more than their vertically challenged friends.

The researchers asked 1,461 women over the age of 16 to give details about their salary and measurements.

A fifth of those questioned who fell into the ‘tall’ category said they earned £30,000 and above compared with 10 per cent of women under 5ft8in.

At the same time, 20 per cent of the tall women said they saw their height as a source of ’empowerment and authority’ compared with just 5 per cent of shorter females.

And the study revealed that the taller you are, the more comfortable you are likely to be with your body.

A quarter of women over 5ft8in said they would not change anything about themselves.

In contrast, 90 per cent of females in the ‘short’ category said they were unhappy with their looks, the study for clothing chain Long Tall Sally found.

Arianne Cohen, author of The Tall Book: A Celebration Of Life From On High, said: ‘Research shows that tall people are consistently more successful in the workplace.

‘Not only do they earn more but they’re more likely to be in leadership positions.

‘As taller people have a downward eyecast when speaking to shorter colleagues, they are instinctively perceived to have authority and confidence.

‘It means that those who are taller are respected by their colleagues and bosses, giving them a thriving atmosphere that leads them to more success.’

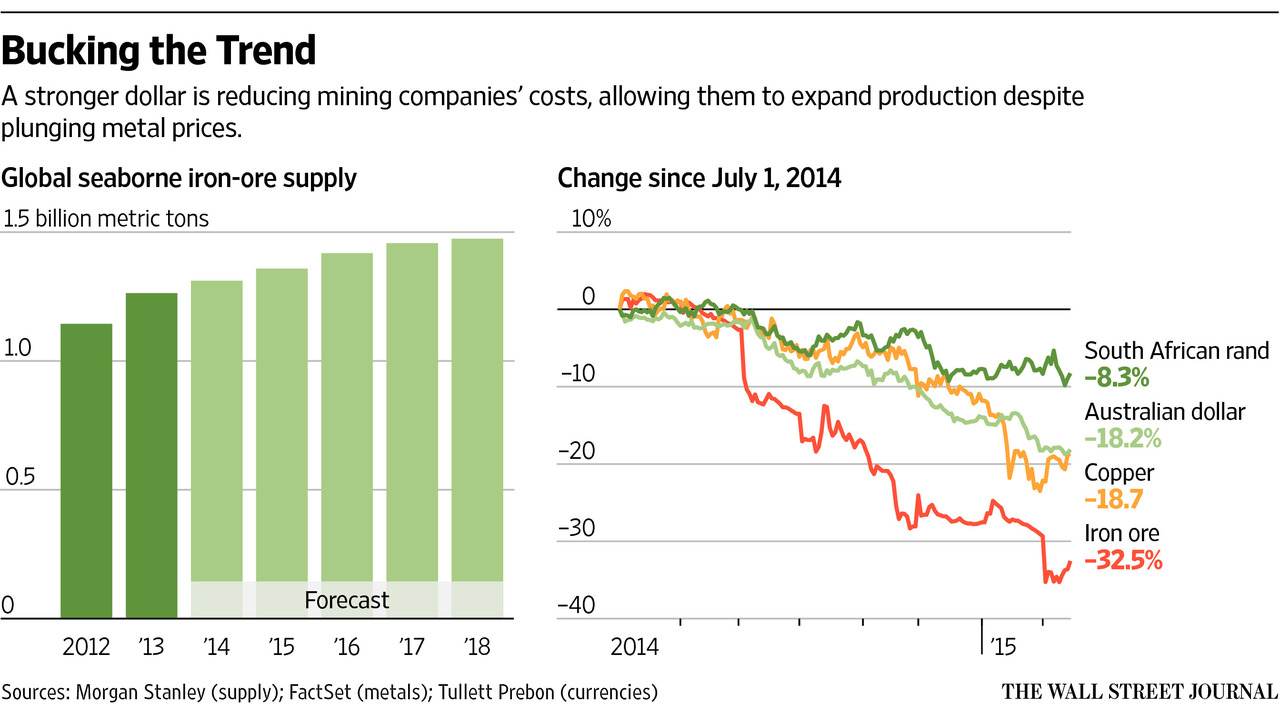

Dollar’s Rise Papers Over Miners’ Woes

Companies ranging from Australian miners BHP Billiton and Rio Tinto to smaller firms like South Africa’s Lonmin PLC are benefiting from the stronger greenback because they receive dollars for the gold, copper and iron ore they dig up, but pay for labor and many other costs using local currencies. When the dollar rallies, revenue generated by metals sales stretch further in covering expenses.

The dollar’s rise is reverberating across the global economy, dividing the corporate world into winners and losers along geographic lines and reshaping the next phase of commodities prices. The greenback rose against virtually all currencies in 2014 and is off to a roaring start this year, as some central banks around the world, reaching for new ways to boost sluggish economic growth, take steps to devalue their currencies.